Grade 9 EMS Assignments Term 3 Questions and Answers

23 August 2021 2021-08-23 10:58Grade 9 EMS Assignments Term 3 Questions and Answers

Grade 9 EMS Assignments Term 3 Questions and Answers

Grade 9 EMS (Economics and Management Sciences) Assignments Term 3 Questions and Answers:

List of Grade 9 EMS Assignments Term 3 Questions and Answers

Assignment 1: The Economy: Trade Unions

Do an investigation on a trade union of your choice, and answer the following questions. Your responses may be based on your findings and any other general information you found to be relevant:

- Question: What is a trade union? (2): ANSWER: A trade union is a group of workers that have joined forces to make sure that there is fairness in the workplace and that employees are paid correctly and their working conditions are acceptable. They try to combat unfair employment practicesas well as abuse and exploitation against workers. (Any relevant answer that is reasonable will be accepted)

- Question: Write down the name of a union you have researched about, and the sector wherein that union operates. (2) ANSWERS: SATAWU NEHAWU SADTU NAPTOSA

- Question: Find and give a brief historical background of formations of unions. (2)

- Question: Why do workers join trade unions? Mention two reasons; (4). ANSWERS:

- For members to receive protection against unfair labour practices like poor working conditions, unacceptable rates of pay and exploitation and abuse.

- To negotiate with employers to improve the working conditions of workers, like working hours, over-time, leave, etc.

- To improve the standard of education and training of members so that workers can gain access to better paying jobs.

- To improve the productivity of workers by ensuring that they get opportunities for training.

- To represent workers in the collective bargaining processes.

- To settle disagreements and grievances between employers and employees.

- To provide professional and legal advice to employees by studying the labour laws.

(Any two of the above answers, and/or any correct answers learners have provided)

- Question: Explain the impact of strikes and stay-aways on:

- The impact of strikes and stay-aways on Businesses (2): ANSWERS: Industrial action can reduce output of a business. Reduce the profits of businesses.

- The impact of strikes and stay-aways on The South African Economy (2): ANSWERS: Create an image of instability in South Africa. Low productivity and economic growth Government generates less taxes (income)

- The impact of strikes and stay-aways on Workers: ANSWERS: No work, no pay can be implemented with strikes. Reduced salaries/wages

As we know, economic development is defined as an increase in the standard of living in a country over a specific period. But what does that have to do with trade unions? With this question in mind, elaborate on the contribution trade unions make towards sustainable growth and development.

Question: Mention three ways in which trade unions contribute)

Answers:

- Work with employers to improve the skills and productivity of workers so that South African goods can compete on the world markets.

- Fight against the trend of globalisation by demanding government protects local industries against competition from abroad.

- Work with employers to ensure optimum employment and employee satisfaction, so that employees work efficiently and show increased production year on year.

Assignment 2: Financial Literacy

Posting to debtors ledger, general ledger and the accounting equation

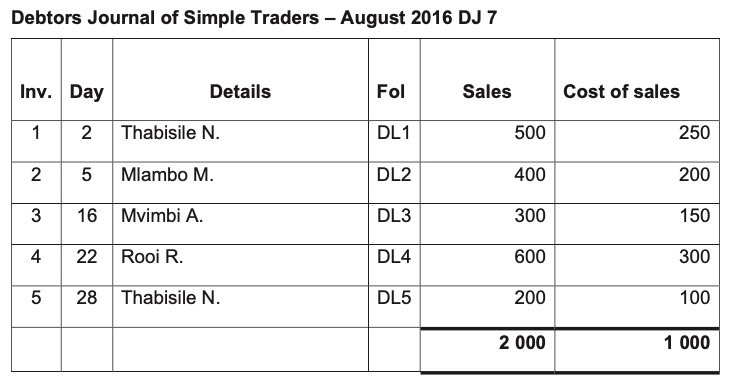

- Posting the debtor’s journal to the ledgers.

- Post the debtors journal below to the debtor’s ledger and the general ledger

Classify the following transactions according to the elements of accounting equation.

Transaction:

Brian A., a debtor, purchased goods on credit, R500. Cost of sales, R350.

Find all answers on the below Document:

Assignment 3: Case Study

Read the following case study and answer the questions that follow:

Forms of ownership, CRJ, CPJ, account equation

Mr Jacobs has three sons and one daughter. He is a sole trader with three taxis. His sons drive the taxis and his daughter would like to learn to do the financial records of the business. Mr Jacobs would like to change his form of ownership so that all his children can have a share of the ownership of the business. However, he does not want to put their personal assets at risk or give up ownership to people he does not know. Jabu, the eldest son, would like to form a close corporation as he has heard that it is the cheapest and the best option. Themba, the youngest, says that a public company will be better as they will be able to buy a huge fleet of taxis and make massive profits. Mr Jacobs’s wife went into hospital for an emergency operation and Swazi, their daughter, has tried to complete the cash journals but she has made a number of errors. (2)

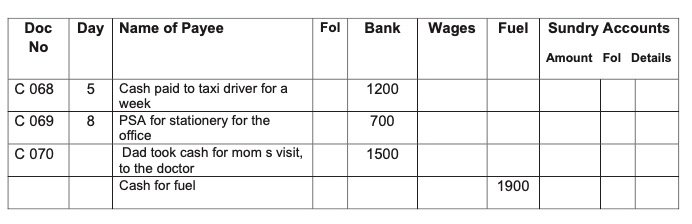

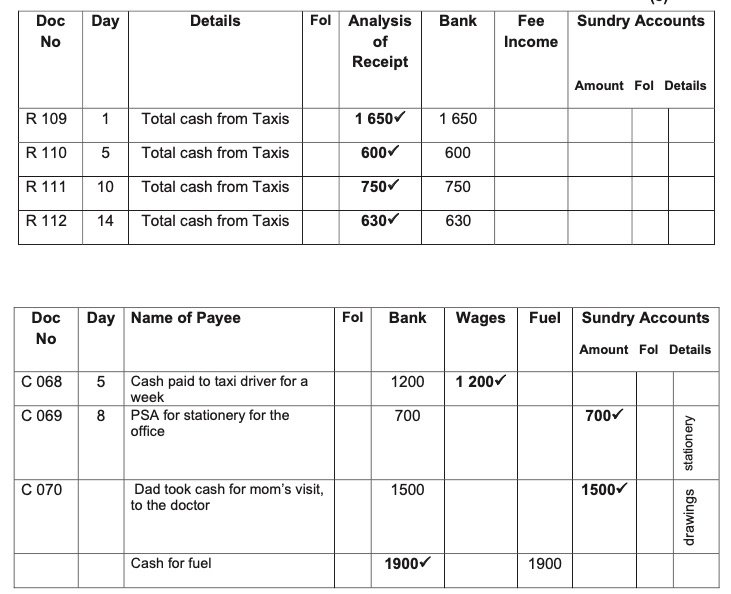

Below are the Journals:

Close Corporation is one of the forms of ownership, and Mr Mabena would not be advised to open it.

- Why is a close corporation not an option? (2): Answer: The Companies Act prohibits the establishment of new close corporations. However, existing ones may continue as CC’s. Mr Jacobs is not a CC and therefore cannot select this as an option.

- What kind of business does Mr Mabena have? (1). Answer: TA service business / Taxi

- Differentiate between a service and trade business. (2). Answer: A service business renders a service e.g. driving people etc, and a trade business sells goods, like clothing stores etc.

- Define the following terms:

- Define Wages (2): Answer: Monetary compensation paid by an employer to an employee within a period of a week or two in exchange for work done.

- Define Analysis of receipts column, and (2). Answer: Is a column in the Cash Receipts Journal that serves as a summary of money collected on the particular day before it is deposited in the bank account.(2)

- Define Sundry Accounts column (2). Answer: Are business accounts were miscellaneous accounts are reported or all accounts that columns were not opened for.

Advise Mr Mabena on his business. Your focus should be on the following:

- Suggest a possible form of ownership for his family. (1) Answer: Private Company

- Explain two characteristics of form of owner ship of your choice (4). Answer:

- A private company must have the letters (Pty) Ltd at the end of the name so Mr Mabena would have to change the name of the business.

- The private company is a legal person which can sue and be sued in its own right

- Formed by minimum of one to fifty persons

- It has a limited liability

- Managed by board of directors

- List two advantages of the form of ownership you chose (4). Answer:

- They will be responsible and liable for the debts of their business.

- This means that the children will not risk their private assets.

- There is continuity.

Give Swazi advice on how to correct her errors on the journals she has drawn. (8)

- The amounts in the bank column should match the deposits on the bank statement at the end of the month.

- The details column in the Cash Receipts Journal has the name of the person who is paying the money, or just the term ‘cash’.

- All cash received that represents fee income, must also be written in the Fee Income column.

- The interest received from the Bank is not fee income so must be entered in the Sundry accounts column.

- The account that it is going to is entered in the Sundry Accounts details column e.g. interest income.

- The name of the bank is entered in the CRJ details column.

- The details column of the CPJ should have the name of the person or business that the cheque is written out to.

- If it is a cash cheque, the word cash is used.

- All the amounts are entered in the Bank column as we regard any cheque payments as going out of the bank account immediately.

- The amounts are then analysed into the various analysis columns.

- All amounts for wages are also entered in the wages column.

- All amounts for Fuel are also entered in the fuel column.

- Any other amounts must be entered in the Sundry accounts column.

- The details will be the account that the amount represents e.g. Vehicle repairs.

- Both the CRJ and CPJ must be totalled at the end of the month.

What is the importance of record keeping?

- It helps the business to monitor progress

- It helps the business to prepare financial statements

- They keep a proper track records of the business

- Assist in improving the business’s progress.

Questions and Answers

My Courses has a large Questions and Answers repository for the most popular High School and Tertiary Schools subjects. This comes in handy when doing your revision or preparing for exams, tests, research tasks, and assignments.